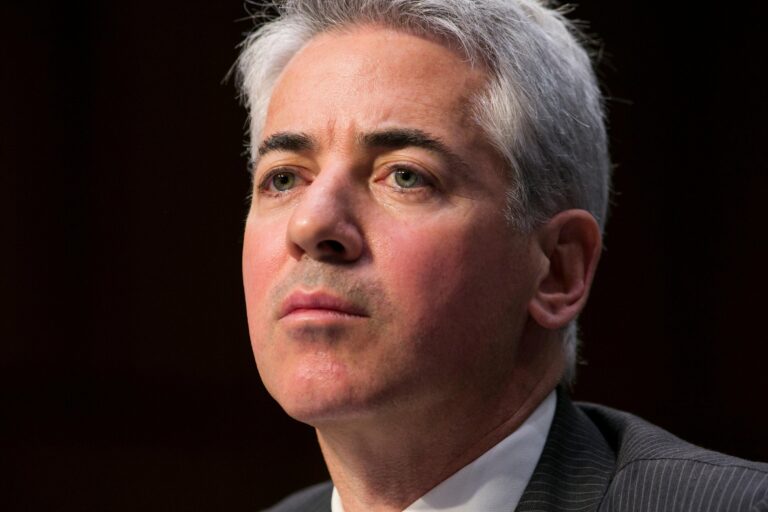

Invoice Ackman, whose Pershing Sq. Holdings is one among Common Music Group (UMG)’s largest shareholders, has massively decreased the worth goal for the IPO of his new US-based closed-end fund.

Ackman gained a number of press consideration when Pershing Sq. Capital Administration (PSCM) – the unique funding supervisor for Pershing Sq. Holdings – offered a ten% stake in June to a bunch of funding funds for $1.05 billion, valuing PSCM at $10.5 billion.

That reportedly elevated Ackman’s personal web price by some $4 billion.

It additionally spurred renewed chatter about Pershing Sq. USA, a brand new closed-end fund that Ackman plans to drift on the New York Inventory Alternate. (His current fund, PSH, trades on the Amsterdam trade, like UMG itself.)

According to Bloomberg News, Ackman had been concentrating on an IPO worth of $25 billion for Pershing Sq. USA, which might have made it the highest-priced closed-end fund ever to IPO.

Stories suggested that worth might have needed to do with the social media clout that Ackman has gained over the past yr. Ackman has turn into one thing of a celeb on X (previously Twitter), together with his posts criticizing what he sees as a rise in antisemitic sentiment in US politics because the October 7 assault on Israel by Hamas.

Nevertheless, right this moment (July 30), Pershing Sq. USA Ltd. confirmed that it has filed an replace with the US Securities & Alternate Fee (SEC) indicating an mixture providing dimension for its firm of USD $2 billion — lower than one-tenth of that initially-expected $25 billion worth.

The agency expects an mixture providing of 40 million shares priced at $50 every, in line with right this moment’s submitting.

Bloomberg reports that the IPO is anticipated to cost subsequent week on August 5 after the NYSE’s shut, with inventory starting to buying and selling the following day (August 6).

The appreciable scaling-back of expectations surrounding the fund raises some questions in regards to the scale of capital Pershing Sq. USA can have for investments, together with potential investments within the music business.

In an evaluation final month, MBW advised {that a} $25 billion fund run by Ackman may doubtlessly be excellent news for the music business, and notably UMG, as Ackman has been a booster for each, arguing that music is underpriced and that UMG is among the many greatest bets inside the business.

In a letter priming the market for a discount within the IPO’s dimension issued final Wednesday (July 25), Ackman stated that Pershing Sq. had “reshaped [its] considering on the transaction” after quite a few conferences with potential traders within the capital markets area.

“In abstract, there’s huge sensitivity to the scale of the transaction. Significantly in gentle of the novelty of the construction and closed finish funds’ very unfavorable buying and selling historical past, it requires a major leap of religion and finally cautious evaluation and judgment for traders to acknowledge that this closed finish firm will commerce at a premium after the IPO when only a few in historical past have finished so,” Ackman wrote.

“The $25 billion quantity within the media initially anchored traders in considering the deal can be too massive. Finally, I anticipate this ‘anchoring’ to be useful to the ultimate end result.”

Ackman added in that letter: “We now have dedicated to restrict provide versus potential demand in order that the [Pershing Square USA] inventory trades properly within the aftermarket together with asserting a tough cap on dimension at $10 billion.”

Even on the new worth level, the IPO of Pershing Sq. USA can be one of many largest this yr, the New York Occasions reported.

“The $25 billion quantity within the media initially anchored traders in considering the deal can be too massive. Finally, I anticipate this ‘anchoring’ to be useful to the ultimate end result.”

Invoice Ackman, Pershing Sq.

As of final rely, Ackman’s Pershing Sq. Holdings – that’s the Europe-based fund – holds some 10.25% of UMG, making it the third largest shareholder behind Tencent-led consortium Concerto Companions (roughly 20%) and former Vivendi president Vincent Bolloré (18%).

UMG is a vital a part of PSH’s portfolio, amounting to 24.9% of its web belongings, in line with the fund’s most up-to-date annual report.

Ackman’s portfolio took a success final week, when UMG’s share worth dove by double digits following a Q2 earnings report that – although general sturdy – confirmed a larger-than-expected slowdown in earnings from paid streaming subscriptions and a decline in income from ad-supported subscriptions.Music Enterprise Worldwide