Key Insights

Common Music Group’s vital insider possession suggests inherent pursuits in firm’s growth

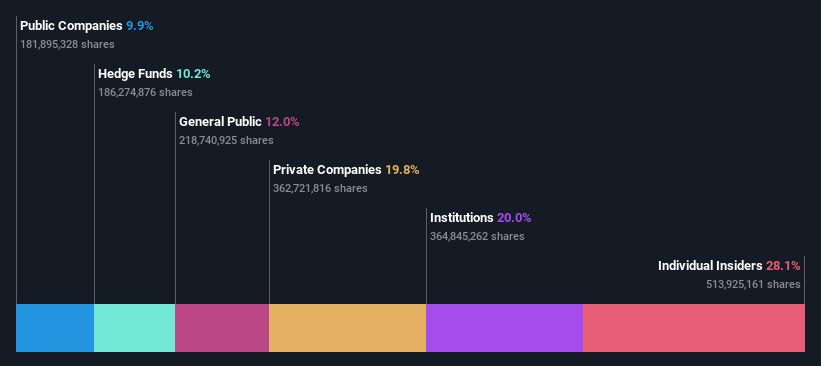

A complete of 5 traders have a majority stake within the firm with 58% possession

Institutions own 20% of Universal Music Group

A take a look at the shareholders of Common Music Group N.V. (AMS:UMG) can inform us which group is strongest. With 28% stake, particular person insiders possess the utmost shares within the firm. Put one other approach, the group faces the utmost upside potential (or draw back threat).

So it follows, each resolution made by insiders of Common Music Group relating to the corporate’s future can be essential to them.

Within the chart beneath, we zoom in on the totally different possession teams of Common Music Group.

See our latest analysis for Universal Music Group

ownership-breakdown

What Does The Institutional Possession Inform Us About Common Music Group?

Establishments usually measure themselves in opposition to a benchmark when reporting to their very own traders, in order that they typically develop into extra enthusiastic a couple of inventory as soon as it is included in a serious index. We’d anticipate most corporations to have some establishments on the register, particularly if they’re rising.

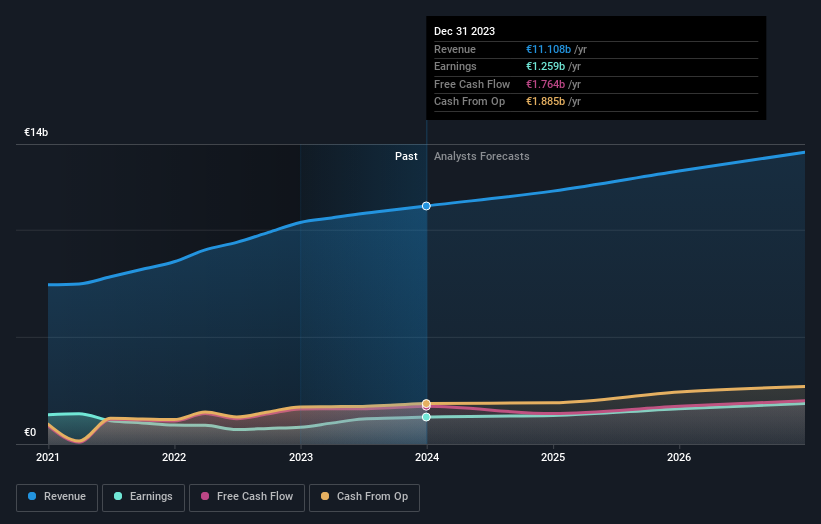

We will see that Common Music Group does have institutional traders; and so they maintain a superb portion of the corporate’s inventory. This means some credibility amongst skilled traders. However we won’t depend on that truth alone since establishments make dangerous investments generally, identical to everybody does. It’s not unusual to see an enormous share value drop if two giant institutional traders attempt to promote out of a inventory on the identical time. So it’s price checking the previous earnings trajectory of Common Music Group, (beneath). In fact, understand that there are different components to contemplate, too.

earnings-and-revenue-growth

It appears like hedge funds personal 10% of Common Music Group shares. That is attention-grabbing, as a result of hedge funds may be fairly lively and activist. Many search for medium time period catalysts that may drive the share value greater. Vincent Bollore is at the moment the most important shareholder, with 18% of shares excellent. The second and third largest shareholders are William Ackman and Pershing Sq. Capital Administration, L.P., with an equal quantity of shares to their title at 10%.

Our analysis additionally delivered to mild the truth that roughly 58% of the corporate is managed by the highest 5 shareholders suggesting that these homeowners wield vital affect on the enterprise.

Researching institutional possession is an efficient approach to gauge and filter a inventory’s anticipated efficiency. The identical may be achieved by learning analyst sentiments. There are an inexpensive variety of analysts protecting the inventory, so it may be helpful to seek out out their mixture view on the long run.

Story continues

Insider Possession Of Common Music Group

Whereas the exact definition of an insider may be subjective, virtually everybody considers board members to be insiders. Administration finally solutions to the board. Nonetheless, it isn’t unusual for managers to be govt board members, particularly if they’re a founder or the CEO.

I usually take into account insider possession to be a superb factor. Nonetheless, on some events it makes it tougher for different shareholders to carry the board accountable for selections.

It appears insiders personal a major proportion of Common Music Group N.V.. Insiders personal €15b price of shares within the €52b firm. That is fairly significant. It’s good to see this stage of funding. You may check here to see if those insiders have been buying recently.

Basic Public Possession

Most of the people– together with retail traders — personal 12% stake within the firm, and therefore cannot simply be ignored. This measurement of possession, whereas appreciable, will not be sufficient to alter firm coverage if the choice will not be in sync with different giant shareholders.

Non-public Firm Possession

Our knowledge signifies that Non-public Corporations maintain 20%, of the corporate’s shares. It is exhausting to attract any conclusions from this truth alone, so its price wanting into who owns these non-public corporations. Generally insiders or different associated events have an curiosity in shares in a public firm by means of a separate non-public firm.

Public Firm Possession

We will see that public corporations maintain 9.9% of the Common Music Group shares on challenge. This can be a strategic curiosity and the 2 corporations might have associated enterprise pursuits. It may very well be that they’ve de-merged. This holding might be price investigating additional.

Subsequent Steps:

It is at all times price serious about the totally different teams who personal shares in an organization. However to know Common Music Group higher, we have to take into account many different components. For instance, we have found 1 warning sign for Universal Music Group that you ought to be conscious of earlier than investing right here.

However finally it’s the future, not the previous, that may decide how properly the homeowners of this enterprise will do. Due to this fact we predict it advisable to check out this free report showing whether analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which check with the 12-month interval ending on the final date of the month the monetary assertion is dated. This will not be in line with full yr annual report figures.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by elementary knowledge. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.